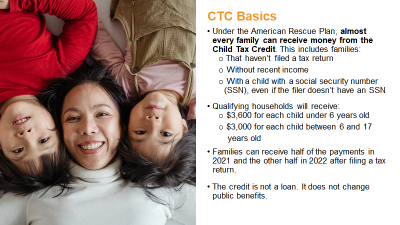

How much are the EITC and CTC worth in 2022?

These are the income guidelines and credit amounts to claim the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) when you file...

Read more →(Training) Becoming a CTC Navigator and Non-filer & CTC Update Portals Walk-through

Navigators are trusted, community-based guides that help marginalized people get their payments.

Read more →(Training) How to best serve and connect immigrants to the Child Tax Credit

Join the NYIC and the Center on Budget and Policy Priorities to learn about the Child Tax Credit, who qualifies, how to address common...

Read more →(Training) All Hands on Deck: Local Strategies for Reaching All Families Eligible for the CTC

In this webinar, you will hear from local communities’ about their strategies for conducting outreach and providing hands-on assistance to ensure all eligible children...

Read more →Getting Started with Child Tax Credit Outreach

Your efforts to help people get advance CTC payments are essential. Many people will need help to understand their eligibility and to use GetCTC.org....

Read more →Four Ways to Promote the EITC for Awareness Day

Friday, January 29, 2021 marks the 15th annual EITC Awareness Day. On this day, the IRS encourages organizations across the country to bring attention to...

Read more →Ten Facts You Didn’t Know about the EITC

In 2018, the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) lifted more than 10.6 million people in working families above the...

Read more →Will getting the EITC or CTC lower government benefits?

Generally, no. In 2013, Congress enacted legislation that permanently excludes any federal tax refund from counting as income in determining eligibility or the amount...

Read more →Six Ways the EITC Helps Kids in Schools

The Earned Income Tax Credit (EITC) is a refundable tax benefit for low- and moderate-income working families. Extra income from the EITC helps at...

Read more →