You must report all income you earn, even if you don’t receive any tax forms from Uber or Lyft. This includes income from any source, no matter how temporary or infrequent. Since you may not receive a tax form for all income sources, it’s important to be able to track your own income.

If you do not report all income, you may run into problems with the IRS in the future. The IRS sometimes audits taxpayers based on tax returns from the past three tax years (or six years if you have underreported your income). An audit means that the IRS will review your financial records to make sure that income is reported correctly and that it matches what you’ve submitted on your tax return.

Understanding your income documents

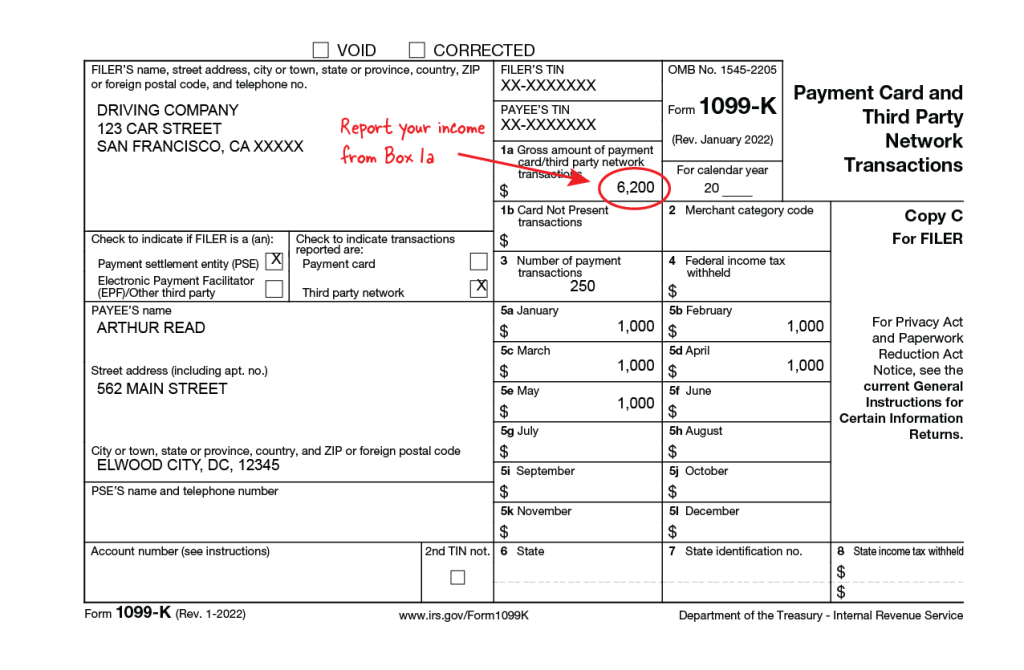

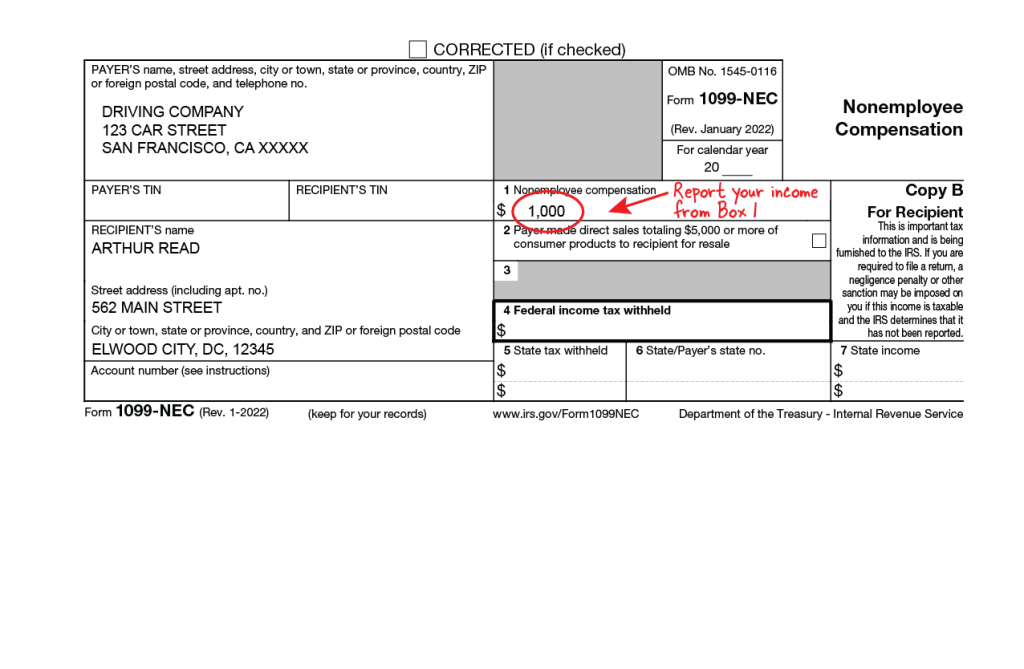

You will likely receive two tax forms from Uber or Lyft. Form 1099-K reports driving income or the amounts received in customer payments for rides provided, and Form 1099-NEC reports any income you earned outside of driving, including incentive payments, referral payments, and earning guarantees. Include the total income from both tax forms on your tax return.

Form 1099-K income will not be reduced by any fees or commissions that Uber or Lyft charge you. You will need to report these fees under your business tax deductions. Otherwise, you will pay taxes on more income than you should.

Sample 1099-K:

Uber income reporting

Uber income reporting

Uber should send Form 1099-K to drivers who earn more than $20,000 in rides and give at least 200 rides during the calendar year. Some states require companies to send Form 1099-K to residents who earn lower amounts. Drivers who make at least $600 in promotional, referral, and miscellaneous income receive Form 1099-NEC.

You can access your tax documents through your partner dashboard. Log into drivers.uber.com and go to the ‘Tax Information’ tab. You should be able to download the tax forms once they are uploaded. If you didn’t give Uber permission to deliver the forms electronically, you will receive the forms in the mail by February 1, 2024. Note: You may not receive any forms if you do not meet the above criteria, but the income must still be reported.

Outside of these official tax documents, Uber provides a tax summary to all drivers that provides a detailed breakdown of annual income and possible business expenses. The possible business tax deductions include a breakdown of miles logged, some expenses, fees, and taxes.

Lyft income reporting

Lyft should send Form 1099-K to drivers who earn more than $20,000 in rides and give at least 200 rides during the calendar year. Some states require companies to send Form 1099-K to residents who earn lower amounts. Drivers who make at least $600 in promotional, referral, and miscellaneous income receive Form 1099-NEC.

Lyft also provides a Driver Dashboard Annual summary that provides a breakdown of annual income and your total miles driven. The breakdown of annual income includes tolls charged to passengers and Lyft’s commission fees, as well as your miles driven. These expenses, fees, and miles should be deducted on your business tax deductions.

You can access these documents through your driver dashboard. Login through lyft.com/login on a desktop or laptop. Click on the ‘Tax Information’ tab and click on the Form 1099 you want to view. These documents will be available by January 31, 2024.

Note: The Uber Tax Summary and Lyft Driver Dashboard contain important information that is generally not available elsewhere. These documents are a critical part of tax preparation. Access the dashboard through the website, rather than your rideshare app, since the website version has more information. Don’t do your tax return without them!