Working for a food delivery service is about more than just delivering food. As a self-employed worker, you are treated as a business by the IRS. It’s important to understand the tax implications of your side (or full-time) gig.

Food delivery services are rapidly growing. Some of the food delivery services you may work for include Grubhub, Postmates, DoorDash, and UberEATS.

These are the key steps to filing your taxes:

- Understand how self-employment taxes work. You pay self-employment taxes in addition to your regular income taxes. This means you may have a larger tax bill when you file.

- Track your tax deductions. You are eligible to claim tax deductions for business expenses that can reduce your taxes. Don’t rely on food delivery companies to do it for you, as they don’t track everything! Compile a list of these tax deductions with receipts and keep a mileage log if you use your vehicle for deliveries, so you’re prepared to file.

- Pay taxes as you go. Your taxes are NOT automatically taken out of your income. Make estimated payments throughout the year to avoid a penalty.

- File your taxes. You’ll need to file Forms Schedule C and Schedule SE with Form 1040. You’ll find your delivery income information on your delivery dashboard, your Form 1099-NEC, and/or your Form 1099-K. To prepare to file, you can fill out the Rideshare Tax Organizer and find free tax filing locations in your area.

Unlike many employers, food delivery companies don’t provide benefits like sick leave or health insurance. When you sign up with the company, you don’t fill out a form to withhold taxes throughout the year. And, importantly, companies like Grubhub, Postmates, DoorDash, and UberEATS won’t pay a portion of your taxes for you.

This guide will cover how self-employment taxes work, how to count your delivery driving income, how to track tax deductions, and how to pay estimated taxes.

Are food delivery couriers self-employed?

If you deliver food for GrubHub, Postmates, DoorDash, or UberEATS, you are self-employed. As a delivery provider for these companies, you are an independent contractor rather than an employee. As an independent contractor, you provide delivery services to individuals. While working for delivery service companies, you set your own work hours and usually provide your own car or other method of transportation and other resources necessary to do your job.

How does self-employment tax work?

Understanding self-employment tax

Self-employment tax is paid in addition to your regular income tax. It is possible to owe $0 in income tax and still owe self-employment tax. When you pay self-employment tax, you help fund Medicare and Social Security. These payments are your contributions to your Social Security pension and Medicare eligibility. If you were an employee, part of these contributions would be withheld from your pay and the other part would be paid by your employer.

Because you work for yourself, you are responsible for both the “employer” and “employee” portions of the tax. For Tax Year 2023 (returns filed in 2024), the self-employment tax rate is 15.3 percent.

Who must file taxes?

If you earn more than $400 from GrubHub, Postmates, DoorDash, or UberEATS, you must file a tax return and report your delivery earnings to the IRS. Most delivery providers report income as sole proprietors, which allows you to report business income on your personal tax return. If you earned less than $400 from your delivery work, you may still have to file and report your earnings if you have to file for other reasons such as claiming refundable credits like the Earned Income Tax Credit, the Child Tax Credit, and the Recovery Rebate Credit.

Which forms do you use to file self-employment taxes?

You will file Schedule C to report your business income and expenses to the IRS. On the Schedule C form, you record all your business income (Grubhub, Postmates, DoorDash, and UberEATS income) and business tax deductions (expenses). You pay taxes on your net income, which is your total income minus any business tax deductions.

You have several options for preparing and filing your taxes. One option is to visit GetYourRefund.org for free virtual tax preparation. Depending on your income and needs, GetYourRefund will direct you to full-service virtual tax filing, free tax preparation services, or free in-person services. They serve people making up to $79,000.

How do food delivery couriers count income?

You must report all income you earn, even if you don’t receive any tax forms from GrubHub, Postmates, DoorDash, or UberEATS. This includes income from any source, no matter how temporary or infrequent. Since you may not receive a tax form for all income sources, it’s important to be able to track your own income.

If you do not report all income, you may run into problems with the IRS in the future. The IRS sometimes audits taxpayers based on tax returns from the past three tax years (or six years if you have underreported your income). An audit means that the IRS will review your financial records to make sure that income is reported correctly and that it matches what you’ve submitted on your tax return.

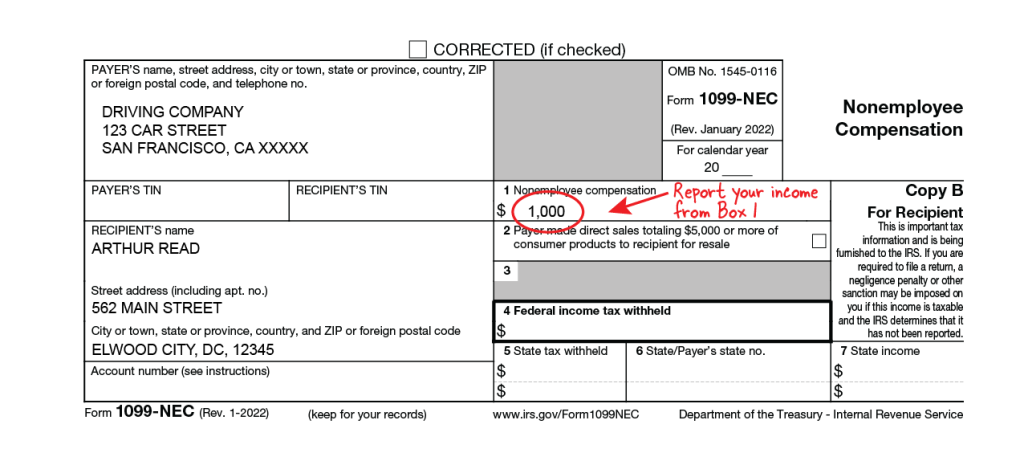

You will likely receive Form 1099-NEC from Grubhub, Postmates, and DoorDash if you earn more than $600 during the calendar year.

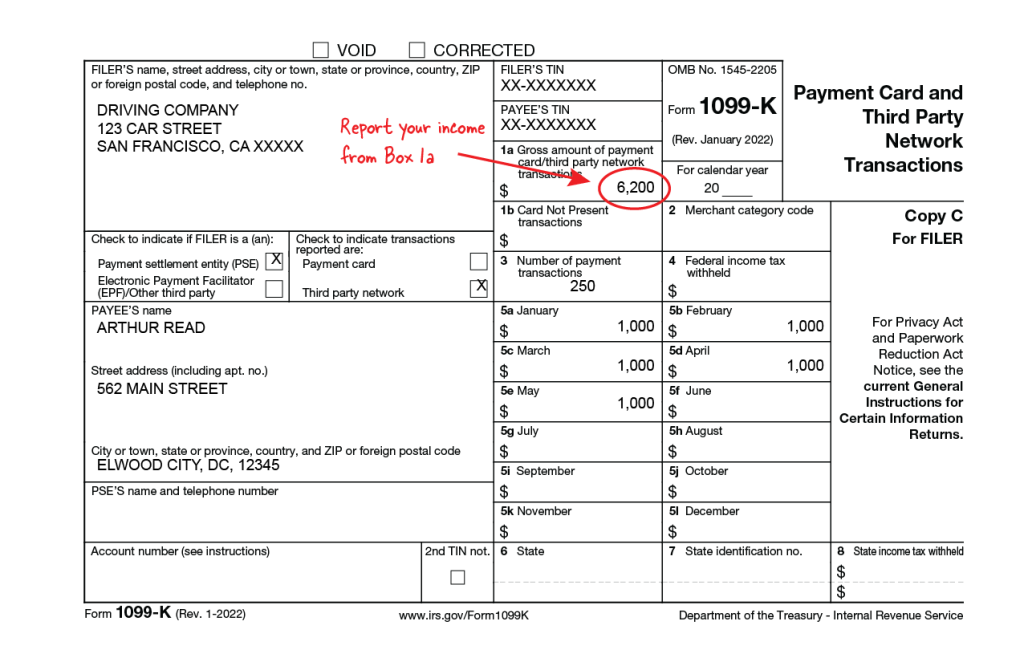

UberEATS reports income differently than the other platforms. You will likely receive Form 1099-NEC if you earn more than $600 in trip supplements, quests and bonuses, and referral fees. If you earned at least $20,000 and made at least 200 deliveries during a calendar year, you may also receive Form 1099-K.

Form 1099-K income will not be reduced by any fees or commission that UberEATS charges you. You will need to report these fees under your business tax deductions. Otherwise, you will pay taxes on more income than you should.

Sample 1099-NEC:

Sample 1099-K:

Changes to who receives Form 1099-K are coming. Learn more about upcoming Form 1099-K changes here.

Grubhub income reporting

Grubhub sends Form 1099-NEC, which reports your annual earnings, if you earn more than $600 during a calendar year.

It is important that you keep a copy of your earning summaries throughout the year. The Grubhub for Drivers app only allows you to see your last 8 summaries. Alternatively, you can keep a record of the direct deposits you receive from Grubhub that should be in your bank statement. If you earn less than $600 during a calendar year, you can refer back to your earning summaries or direct deposits to calculate your earnings.

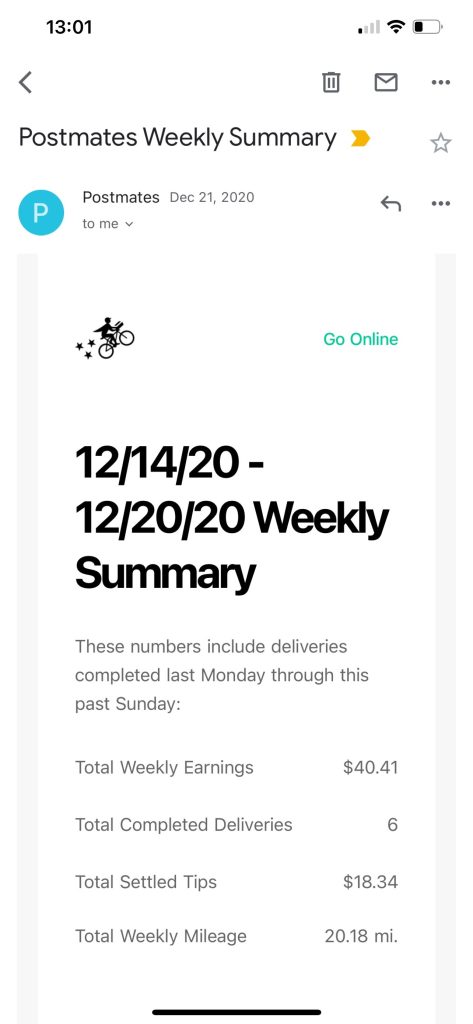

Postmates income reporting

Postmates was acquired by Uber in 2021 so Postmates drivers will receive their forms from Uber. Uber sends a Form 1099-NEC, which reports your annual earnings, if you made at least $600 in non-trip earnings. This includes referral payments, bonuses, and other income that comes from something other than deliveries. You will receive Form 1099-K if you earn more than $20,000 in gross delivery earnings (delivery fees and customer tips) and complete more than 200 trips in a calendar year.

If you earn less than $600, Uber will provide a tax summary to all delivery drivers that provides a detailed breakdown of annual income and possible business expenses. The possible business tax deductions include a breakdown of miles logged, some expenses, fees, and taxes. You can refer to this tax summary to report your income, even if you don’t receive a Form 1099-NEC or Form 1099-K.

Sample Postmates Weekly Pay Statements:

DoorDash income reporting

DoorDash sends Form 1099-NEC, which reports your annual earnings, if you earn more than $600 on the DoorDash platform during a calendar year. It is important that you keep track of your weekly direct deposits from DoorDash. The Dasher app does not keep a full year record of your earnings. If you earn less than $600 during a calendar year, you can refer back to your direct deposits to calculate your earnings.

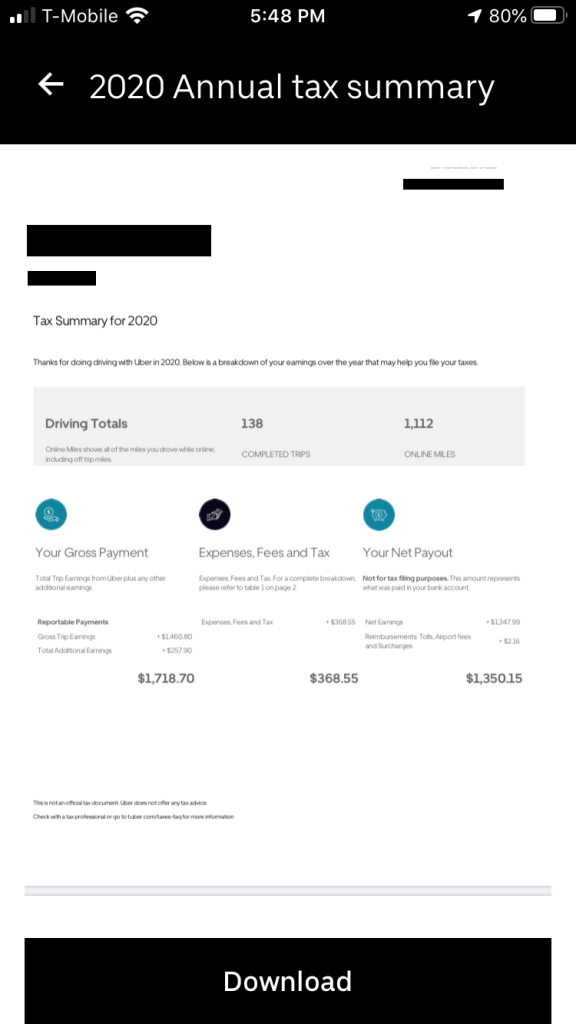

UberEats income reporting

Usually, for food delivery companies, you will only receive Form 1099-NEC (if you earned more than $600), not Form 1099-K. In the case of UberEATS, if you earn at least $20,000 in delivery transactions (delivery fees and customer tips) and complete at least 200 deliveries in a calendar year, you will receive Form 1099-K. If you earn at least $600 outside of delivery transactions, including referral bonuses or quests, you receive Form 1099-NEC.

Even if you earn less than $600, UberEats provides a tax summary to all delivery drivers that provides a detailed breakdown of annual income and possible business expenses. The possible business tax deductions include a breakdown of miles logged, some expenses, fees, and taxes. You can refer to this tax summary to report your income, even if you don’t receive a Form 1099-NEC.

To access your tax summary in the UberEats app, click the menu icon on the top left of your home screen. Select “Account” and then “Tax Info.” You will be taken to a page that allows you to change your tax information, view your tax summaries, and retrieve your 1099-K, 1099-MISC, and 1099-NEC. Select “Tax Summaries” to access your annual tax summary.

Sample UberEats Tax Summary:

Note: Most food delivery dashboards do not provide an annual summary of your earnings. Be sure to keep your own consistent record of your weekly statement earnings or direct deposits. This information is a critical part of tax preparation. You won’t be able to complete an accurate tax return without them.

Track tax deductions (business expenses)

As a self-employed worker, tax deductions (like the mileage deduction if you use a car for deliveries) are the best way to prepare an accurate tax return and lower your taxes. If you don’t take these deductions, more of your income will be subject to both income and self-employment taxes. If you use a vehicle for deliveries, your biggest deduction will be mileage, so make sure you’re tracking how much you’re driving. You cannot take the mileage deduction if you use a bicycle for deliveries.

You may not think of yourself as a business owner, but you are. Food delivery couriers can track the costs associated with deliveries, like mileage or hot bags and blankets and take these expenses as tax deductions. These tax deductions are for any expenses that are common and helpful for providing food deliveries. As a food delivery courier, your biggest business expenses may be costs related to your car.

Make sure to track tax deductions as you go—it is much harder to recreate records later! Tracking tax deductions can also help you determine whether your driving is profitable.

Tracking tax deductions

Here is a list of tax deductions you can claim:

- Car mileage

- USB chargers and cables

- Dashboard mounting systems

- Cost of phone and phone plan

- Cost of bike repairs and accessories

- Parking and tolls fees

- Food courier bags, backpacks, and blankets

- Vehicle inspection

- Commissions and fees

- Car insurance, roadside assistance, and registration costs

- Health insurance expenses

- Mile tracker app

- Personal protective equipment

- Delivery uniform

Keep in mind that you can only deduct the costs of these expenses that are used when you are working. For example, if you use your phone 50% of the time for deliveries, you can only deduct 50% of your phone and phone plan cost. If you pay for a roadside assistance plan, you can deduct a portion of the cost based on the proportion of miles you drive for deliveries.

Tracking the mileage deduction

Most food delivery apps DO NOT track how many miles you’re driving when you’re online. If you don’t track them yourself, you will pay more in taxes. You can only use mileage deductions for cars.

There are two ways to track your mileage deduction. If you drive a car, you can choose between either the standard mileage or actual expenses method.

- Standard mileage. Multiply your business miles driven by the standard rate. Multiply your business miles driven by the standard rate. For 2023 the rate is $0.655. The rate includes driving costs, gas, repairs/maintenance, and depreciation. Do NOT deduct these costs separately. This is the more common and easiest option.

- Actual car expenses. Track your driving expenses yourself. Actual car expenses are difficult to track, so seek professional tax help.

Tracking actual car, truck, and bike expense tax deductions is a more complicated method than using standard mileage. In addition to tracking your business and personal mileage, you’ll need to track all your car expenses, such as gas, repairs/maintenance, insurance, license fees, parking fees for business, tires, car washing, lease payments, towing charges, and auto club dues. In addition, you can deduct a portion of your car as “business use” and deduct the depreciation of your car’s value. See the page for actual car expenses to learn more.

With either method, you’ll need to keep a carefully detailed mileage log to deduct these costs. Not all miles driven can be deducted. For example, miles driven from your home to your first pickup of the day are considered your “commute” to work and not counted as business expenses. Any personal driving you do during the day (such as your lunch break) cannot be counted either.

Luckily, there are apps and tools to help make tracking tax deductions easier. This guide on tracking mileage has more information.

How to Claim the Standard Mileage Deduction

How to pay quarterly estimated taxes

People who work for an employer have a portion of their medicare and social security taxes taken out of each paycheck. Their employer pays the other portion on their behalf. Additionally, as part of their total tax withholding, employees pay taxes on their income as they earn it. Ideally, the total amount withheld will cover any income taxes owed. Since self-employed workers don’t have withholding, you’ll need to pay your own taxes during the tax year.

If you expect to owe more than $1,000 in taxes (that’s earning roughly $5,000 in self-employment income), then you are required to pay estimated taxes. If you don’t make estimated tax payments, you may be charged a penalty by the IRS.

You are required to pay 100 percent of the total of your last year’s income taxes or 90 percent of the current year’s taxes. If you make over $75,000 as a single filer ($150,000 if married filing jointly) in self-employment income, you must pay 110 percent of last year’s taxes. If you are driving for the first time, estimate your yearly salary based on your weekly earnings.

Most self-employed workers pay quarterly estimated taxes, but you can find a schedule that works for you. For example, you can treat self-employment taxes like a bill and pay a portion every month when other bills are due.

Estimated payments are due four times a year on the following dates:

| Income from: | Quarterly Estimated Taxes Due: |

| January 1 to March 31 | April 15 |

| April 1 to May 31 | June 15 |

| June 1 to August 31 | September 15 |

| September 1 to December 31 | January 15 of the following year |

Submit your payments by mail or online using the Electronic Federal Tax Payment System.

Quarterly Estimated Payments Due Dates

Quarterly Estimated Payments Due Dates

What resources are available to help me with my taxes?

First, review this guide so that you can become familiar with the tax filing process for food delivery drivers.

Track your tax deductions in a spreadsheet (printable spreadsheet) or an app. For example, if you want to use an app, you can track your mileage on Stride Tax (free) and MileIQ ($5.99 billed monthly for unlimited trips, free for the first 40 trips).

Finally, use the Rideshare Tax Organizer, which helps you make sure you have everything you need.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities and the CASH Campaign of Maryland are not liable for how you use this information. Please seek a tax professional for personal tax advice.