Friday, January 27, 2023, marks the 17th annual Earned Income Tax Credit (EITC) Awareness Day! This is an opportunity for organizations across the country to promote the EITC through hosting events, sharing information online, and engaging the media.

The EITC is a critical opportunity for individuals and families with low and moderate incomes to better afford the rising cost of essentials. In 2022, 31 million workers and families claimed nearly $64 billion from the Federal EITC.

As you help connect your community with the EITC, you can also highlight free tax preparation services and other refundable tax credits, like the Child Tax Credit (CTC) and the American Opportunity Tax Credit.

Here are some ways you can celebrate EITC Awareness Day.

1. Post graphics on social media

We have created a variety of social media graphics that you can share on Facebook, Twitter, and Instagram.

2. Generate media attention

Connecting with the media allows you to spread the word about the EITC beyond your established network! Use these messaging and earned media materials to conduct local media outreach that will encourage reporters and producers to cover tax credits like the EITC and CTC.

You can also use this dashboard to locate data on EITC and CTC claims by state. Reporters and producers may find it useful to hear about the types of taxpayers that claim the tax credits.

3. Share EITC resources with clients and partners

Distribute outreach materials about tax credits to individuals, families, and partner organizations. This can help people to learn who can claim tax credits and to connect with free tax help.

4. Post these blogs

Share these blogs on Facebook, Twitter, and Instagram or repost to your blog. Let us know if you reblog a post.

- How much are the EITC and CTC worth in 2023?

- Six Ways the EITC Helps Kids in Schools

- Ten Facts You Didn’t Know about the EITC

- Will getting the EITC or CTC lower other government benefits?

- Can immigrant workers get the EITC?

- The Earned Income Tax Credit Supports Fathers

- Four Reasons Every Parents Should Know About the Earned Income Tax Credit

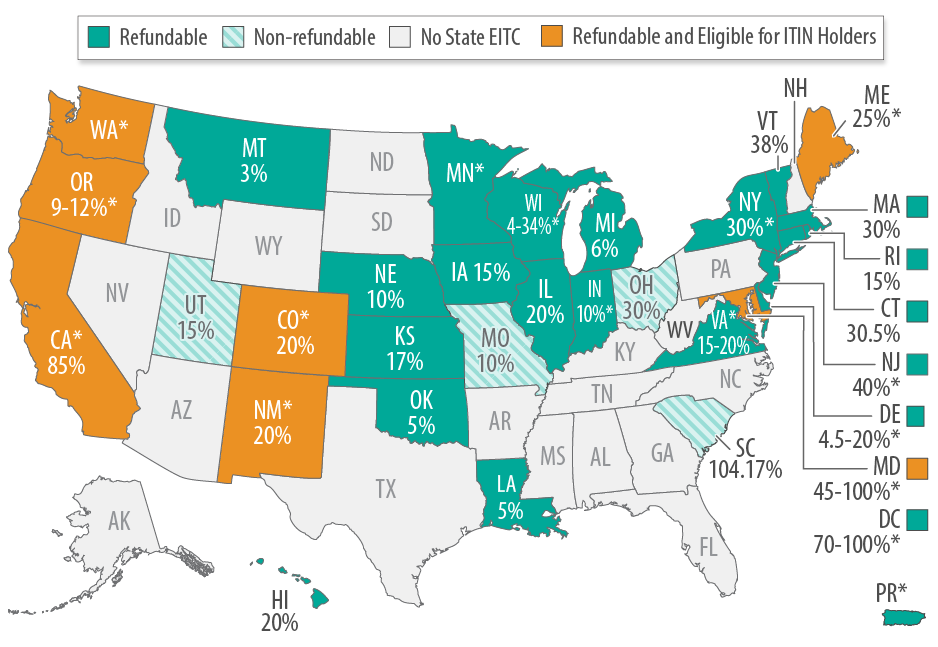

5. Promote state EITCs

Beyond the federal EITC, 31 states plus D.C. and Puerto Rico have their own state EITCs. This means eligible individuals and families could get even more money back during tax time. Most state EITCs are refundable. Some states allow people with Individual Taxpayer Identification Numbers (ITINs) to claim the credit even though they don’t qualify for the federal EITC.

If your state has a state EITC, be sure to highlight it in your outreach efforts. Learn more about state EITCs here.

6. Incorporate outreach for 2021 expanded tax credits and stimulus checks

The government passed historic expansions to several tax credits for 2021 only to provide relief due to the COVID pandemic. More people than ever before were eligible to receive money back in their tax refund. It’s not too late for people who were eligible for the expansions and didn’t get them to claim them.

Include the 2021 expanded EITC, 2021 expanded CTC, and the Recovery Rebate Credit in your outreach efforts this year.

Need more ideas?

Tax credits like the EITC are available to people well beyond tax season. Some organizations have created useful resources to help promote the EITC and other tax credits all year! Here are a few:

- Prosperity Now: created a 2023 EITC Awareness Toolkit that includes sample social media messages and EITC state reports.

- National League of Cities: released their EITC Awareness Day Toolkit for local leaders that includes a draft press release, a template email, a template city proclamation, and sample tweets and Facebook posts.

- Urban Institute: maintains a Financial Health and Wellness Dashboard. While not specific to tax credits, it provides data on financial health and wellness across cities and states by race and ethnicity.

- Consumer Financial Protection Bureau: has developed several resources to promote free tax filing options including a social media messaging calendar, a sample blog post, a flyer in English and Spanish, a guide to filing taxes, and videos on local free tax preparation and online free tax prep.

- Internal Revenue Service (IRS): has a Partner Toolkit that includes several resources to incorporate into your outreach activities, including templates, statistics, fact sheets, tips, and social media content.