Last Updated 8/31/2022

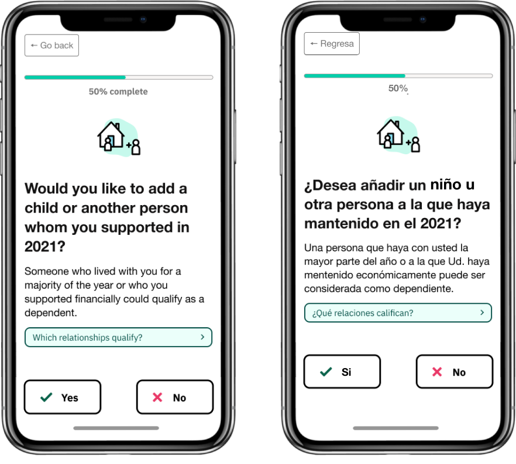

Created in partnership with the White House, GetCTC.org is a mobile-friendly, easy-to-use tool to get your Child Tax Credit and third stimulus check, even if you don’t have tax documents. It is also available in Spanish.

Because of a temporary law change, more families qualify for and will get money from the Child Tax Credit (CTC), even those that don’t have recent income. You could get up to $3,600 per child. Families were eligible to receive the first half of their CTC through monthly payments in 2021. If you need to claim the second half of your CTC or you didn’t receive the advance payments, you are able to claim the CTC when you file your 2021 tax return (which you file in 2022).

Even if you don’t owe taxes or have no income, you can still get this full tax credit. Use GetCTC.org to claim your CTC or your third stimulus check as the Recovery Rebate Credit if you don’t need to file a 2021 tax return.

To use GetCTC, you will need:

Required

- A computer or cell phone with access to the internet: the form works well on phones

- Full legal name for yourself and qualifying children

- Your SSN or Individual Taxpayer Identification Number (ITIN) and SSNs for your qualifying children

- Date of Birth for yourself and qualifying children

- Mailing address: If you are unhoused or don’t have a permanent address, ask your local shelter or service provider if you can use their address. If you can’t find one that will provide permission, you can also ask to use a trusted relative’s or friend’s address. The IRS will deliver checks to P.O. boxes.

- Phone Number that can receive texts OR an Email Address: Your phone number or email address will be used to verify your identify and to provide updates about your simplified return. If you don’t remember or have the password to your email, you can create a new email address for free through a website like Gmail, Yahoo! Mail, or AOL.

Optional

- Bank Account direct deposit/routing number (optional): Direct deposit is the quickest and safest way to get your payment. If you don’t have a bank account, you can still get your payment through direct deposit using a prepaid reloadable debit card, CashApp, Venmo, or PayPal, or opening an online bank account. If you cannot use these options, you’ll get your payments as a paper check.

- Your 2020 Adjusted Gross Income (optional): If you filed a 2020 tax return (which you file in 2021), you’ll need to enter your exact 2020 Adjusted Gross Income to use GetCTC.

- Driver’s License or state issued ID (optional): If you haven’t filed taxes before, providing this info could help the IRS issue your refund faster.

- Amount of any advance CTC payments received in 2021 (optional): This information helps the IRS process your return. If you are unsure of the exact amount you received, you can check your IRS Letter 6419 (sent in January 2022), your bank account statements if you had the payments direct deposited, or your IRS online account (if you have one). If you cannot find the amount of your advance payments, you can use your best guess. If the amount you report is wrong, the IRS may delay the processing of your refund.

- Amount of the third stimulus check you received (optional): This information helps the IRS process your return. If you are unsure of the exact amount you received, you can check your IRS Letter 6475 (sent in January 2022), your bank account statements if you had the check direct deposited, or your IRS online account (if you have one).

- Identity Protection PIN (IP PIN) (optional): The IRS issues IP PINs to people who have experienced identity theft or who have requested an IP PIN. The six-digit number is only required if the IRS has issued one to you or someone on your return.

This is an example of GetCTC. Questions will be asked throughout the process to help determine your eligibility for the CTC and if eligible, the information you submit to GetCTC will be sent to the IRS so that you can claim your CTC and third stimulus check as the Recovery Rebate Credit.

Chat support is available. To learn more about using GetCTC, watch this GetCTC demo video.

If you need additional support, check out the these resources.