By Christine Tran, 2021 Get It Back Campaign Intern

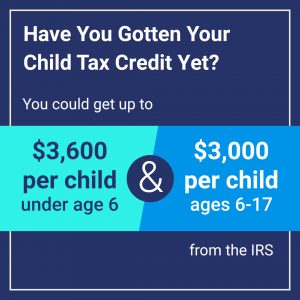

Calling for all hands on deck! About 4 million or more children in families risk missing out on the expanded Child Tax Credit (CTC). We have 6 weeks to connect families who have been hit the hardest by the pandemic to advance CTC payments ($3,600 per child under 6 and $3,000 per child under 17). The deadline for families who aren’t required to file taxes to submit their information to the IRS using GetCTC.org to get their advance payments is November 15, 2021.

Families will get half the payment in 2021, which is at least $1,500. They will receive the rest when they file their 2021 tax return (which you file in 2022). Families that haven’t filed a tax return and families that don’t have recent income can also get the Child Tax Credit and advance payments. Child Tax Credit advance payments can help people put food on the table, make rent, pay bills, afford childcare, and buy school supplies for children.

Additionally, families and individuals who were eligible for stimulus checks and didn’t receive them can use GetCTC.org to do so (they don’t need to be eligible for the CTC to use the tool to get their missing stimulus checks).

Organizations can assist people to access these vital payments. Robust outreach efforts and hands-on support are key to connecting non-filers to the Child Tax Credit.

Pre-Launch:

Decide your role

Assess the role your organization can play in helping people receive their Child Tax Credit advance payments.

Assistor: Help people get their CTC advance payments. You can help individuals submit their information to GetCTC.org. You don’t have to be a tax preparer to help people fill out the form. This is the greatest need to support CTC outreach.

Campaign for Working Families, a non-profit in Philadelphia, offers free in-person and virtual help to sign-up for the Child Tax Credit. Community Legal Services of Philadelphia is providing help to complete the form, connect people to free tax preparation services, and troubleshoot issues. To train your staff to be navigators, watch the video on this Navigator Resources page.

You can also provide Internet access or computers for people to use GetCTC.org, offer to let people use your organization’s mailing address when they fill out the form (a required field), or answer questions about claiming the CTC and using GetCTC. Learn more about ways to be an assistor.

Referrers: Connect people directly to local support to complete the online form and help them set up an appointment, if needed. Local Volunteer Income Tax Assistance (VITA) sites offer free, high quality tax preparation from IRS-certified volunteers. If VITA sites in your area are closed, contact your local United Way, Community Action Agency, Catholic Charities agency, or Accounting Aid Society, which all may help with the CTC.

Referrers can also prepare people for what they need to bring with them to the appointment by using flyers, appointment card reminders, or checklists.

Detroit’s 2021 Child Tax Credit Campaign partnered with community-based organizations like Community Development Advocates of Detroit to conduct neighborhood outreach to share information about the CTC and help residents sign up for tax preparation appointments.

Notifiers: Share information about the CTC advance payments, how to get them, and any places offering support. Publicize resources through emails, texts, social media, flyers, or mailers.

The Office of Community Empowerment and Opportunity in Philadelphia launched street teams to hand out flyers outside of grocery stores, dollar stores, and other public places. The office also sent out mailers to foster care parents and placed informational ads in digital bus shelters and kiosks.

Learn more about how organizations are spreading the word about the CTC.

Connect with local organizations

Learn about current efforts in your community around the Child Tax Credit and advance payments that your organization can join. You don’t have to do this alone! Build partnerships with other organizations to launch community efforts around the CTC if no current efforts exist in your area. Partnering with other organizations can help you share the work.

Reach out to organizations that provide free tax preparation, faith-based organizations, community centers, adult education centers, day care centers, food banks, schools, public libraries, local businesses, legal clinics, homeless and domestic violence shelters, and other organizations that serve harder-to-reach, low-income communities.

Think about the needs in your community and what different organizations can offer. For example, public libraries can provide computers and Internet access. Organizations that serve hard-to-reach populations can refer people to your services or host a CTC sign up event at their organization.

Identify your outreach materials

There are several outreach materials available that you can use. Choose which materials to use based on the goals of your campaign.

- Digital campaign materials: state-specific data, local organizations’ logos, customizable social media graphics and posts, a radio PSA script, a press release template, and newsletter template.

- Physical campaign materials: flyer, postcard, phone banking script, and SMS scripts.

All digital and physical campaign materials can be found in the Get It Back Campaign’s Child Tax Credit Outreach Toolkit.

Outreach Campaign Plan:

Use this suggested campaign plan as a guide to form your organization’s own plan. You can lengthen or shorten your outreach timeline. Adapt the outreach campaign to your organization’s capabilities to create a plan that your organization can realistically achieve in the upcoming weeks.

Week 1

Distribute Flyers. Distribute flyers through your organization and partner groups to reach people you serve throughout the week. Be ready to share how it’s not too late to get the Child Tax Credit advance payments and inform people about how they can sign up for their payments.

- Give a flyer to everyone that visits your organization. Homeless shelters can pass out flyers to community members that use their services. Daycare centers can give flyers to parents.

- Include a flyer in materials you give to your clients. Food banks can attach flyers to food pantry boxes. Organizations that work with schools can supply teachers with flyers to include in take home materials for students.

- Prioritize communities with lower incomes or residential areas with public housing units to place flyers on community members’ doors. Use the Tax Policy Center’s interactive heat map to help identify zip codes to focus on.

Host CTC sign-up day events. Your organization can work directly with people to sign up for CTC advance payments. Philadelphia’s Office of Community Empowerment and Opportunity hosted a CTC sign up day with Community Legal Services of Philadelphia and Campaign for Working Families at a playground.

Provide Internet access, computers, and physical space where people can use GetCTC.org and fill out the form on their own. Recruit staff and volunteers that can help answer questions and troubleshoot. If you don’t have staff capacity, let people know that GetCTC has a live chat function to connect with an IRS-certified volunteer.

Table in public areas such as parks, grocery stores, community centers, thrift stores, and public libraries. Work with schools, faith-based organizations, and shelters to table in their space.

- Ask people that pass by if they have gotten their advance Child Tax Credit payments for their children yet.

- Offer to answer questions about the CTC.

- Direct people to resources to get the CTC, such as your CTC sign up day event.

Sign people up to get CTC payments and missed stimulus checks on the spot using tablets or laptops. Providing outdoor support options is especially important to reach people experiencing homelessness. Since this option is more involved, read these tips to connect people experiencing homelessness to their stimulus checks first.

Coordinate a specific date and time for a social media launch to kick-off the campaign. Your organization and your partners can post social media graphics on Facebook, Instagram, and Twitter.

- Decide if all organizations will post at the same time or stagger social media posts throughout the day.

- Make sure to tag each other in your social media posts to highlight all the organizations that people can turn to!

Assistors can publicize their own services, referrers can publicize other services, and notifiers can publicize general resources.

Phone bank people on your organization’s contact list to remind them to sign up for the CTC and advance payments. Inform them of any in-person or virtual CTC events your organization and partners will host.

Record a message on your automated phone system. Talk about the CTC and resources to get the advance payments as people wait on the line. For example, schools, local government agencies, community centers, shelters, and community housing assistance programs.

Send mailers to people on your organization’s contact list. Include info about the CTC with a mailing your organization already has planned. Assistors can publicize their own services, referrers can publicize other services, and notifiers can publicize general resources.

Week 2

Recruit CTC volunteers. Encourage volunteers and staff members within your organization to volunteer with partner organizations who are directly assisting people to get the CTC advance payments.

Connect with local businesses, public libraries, legal clinics, adult education centers, DMVs, and community centers and ask to place flyers in their establishments.

Door-knock in your community. Coordinate days where volunteers and staff can door-knock in neighborhoods to talk about the CTC, answer questions, and refer people to local resources to sign up for the CTC.

Launch virtual events with partner organizations that explain what the CTC and advance payments are and resources to file.

- This event can be held on platforms like Zoom or Facebook Live.

- Consider featuring different partner organizations that provide a variety of resources, such as in-person assistance, phone assistance, or virtual assistance.

- Choose an exciting keynote speaker to create buzz around the event.

- Promote the event in your phone banking conversations and email blasts about the CTC and advance payments.

- Reach out to state and local agencies or community organizations that work with your targeted population to ask for help publicizing your event.

- Post consistently about the event on your partners’ and your social media platforms.

Email and text people on your organization’s contact list to remind them to get their CTC advance payments if they have not already done so.

Contact community newspapers to request that they can do a story on the CTC to highlight advance payments and how to get help to sign-up. You can use this template pitch.

Contact your local radio stations to request that they run a PSA about the CTC. You can use this radio PSA script (also available in Spanish).

Post social media graphics on Facebook, Instagram, and Twitter.

- Publish this image with the following caption:

| Twitter: ICYMI: You can start receiving monthly payments to help with the cost of raising kids. If you’re filing for the first time, or need help getting the credit, visit GetCTC.org to learn more about how to get your money! |

|

- Publish a post highlighting the number of children at risk of missing advance payments in your state.

- Publish a post featuring specific resources to help people get their payments.

Getting questions about which parent can get the Child Tax Credit advance payments? Refer to this blog to help families understand what to do if someone who isn’t eligible for the CTC is receiving advance payments. Send it directly to families or share widely through social media and email.

Week 3

Continue to host CTC sign up day events and table in public areas.

Distribute flyers to mailboxes of residential homes and in public areas, such as parks, grocery stores, community centers, DMVs, and public libraries. Focus on residential areas that are underserved, where hard-to-reach non-filers may live.

Host an information session to spread the word about the CTC and advance payments.

- Teach people about what the CTC advance payments are.

- Direct people to resources to sign up for advance payments.

- Encourage people to be CTC ambassadors and spread the word to their friends and families.

Email and text people on your organization’s contact list to remind them to get their CTC advance payments if they have not already done so.

Post social media graphics on Facebook, Instagram, and Twitter.

- Publish this image with the following caption:

| Facebook: Help is on the way. The Child Tax Credit is putting money in your family’s hands every month for the things you need, even if you don’t normally file taxes or have recent income. You could get up to $3,600 a year per child. This money is not a loan. Visit GetCTC.org to find out more about how to get your credit. |

|

- Publish a post highlighting that parents and caregivers that have no income can still get the CTC advance payments.

- Publish a post highlighting that after the delivery of the first CTC advance payment, there are 3 million fewer children living in poverty.

- Publish a post featuring specific resources to help people get their payments.

Week 4

Continue to distribute flyers, host CTC sign-up day events, phone bank, and email and text people.

Post social media graphics on Facebook, Instagram, and Twitter.

- Publish this image with the following caption:

| Instagram: Did you know? The new #ChildTaxCredit is putting cash directly in families’ bank accounts. This money is not a loan. Whether it’s groceries, child care, school supplies, or much more, you could get up to $3,600 per child a year to support the cost of raising kids. Click the link in my bio to find out more about how to get your credit. |

|

- Publish a post highlighting that non-citizen parents qualify for the Child Tax Credit if their children have Social Security Numbers. In addition, receiving advance payments will not change immigration status or the ability to apply for citizenship. The IRS generally does not share citizenship information with immigration or any other federal agency.

- Publish a post featuring specific resources to help people get their payments.

Getting questions about what to do if people don’t have a permanent address or bank account information? Refer to this blog to help answer questions for families. Send it to those who need it, or share widely through social media and email.

Week 5

Continue to table in public areas, send mailers, door-knock in your community, and distribute flyers to mailboxes.

Engage local officials and government agencies. Request that your local elected officials and city halls issue a press release about the CTC. Ask government agencies, such as WIC offices and SNAP agencies to notify program participants about the CTC and how to get it.

Post social media graphics on Facebook, Instagram, and Twitter.

- Publish this image with the following caption:

| Twitter: Do you need help covering the cost of raising children? Families can get up to $3,600 per child under age 6 and up to $3,000 per child ages 6 to 17. You don’t want to miss out on getting the #ChildTaxCredit! Visit GetCTC.org to learn more. |

|

- Publish a post highlighting that this money is not a loan and getting the CTC won’t change any federally funded public benefits one receives.

- Publish a post featuring specific resources to help people get their payments.

Getting questions about missed stimulus checks? Refer to this blog to help answer questions for families, Send it to those who need it, or share widely through social media and email.

Week 6

Continue to host as many CTC sign up events as possible this week or extend the hours of your sign-up event. This is the last week for non-filers to be able to get their CTC advance payments. Providing hands-on support and walking families through GetCTC.org will be extremely helpful to connect them to these payments.

Escalate your outreach efforts, driving the sense of urgency to get the advance payments. Pull out all the stops!

- Coordinate large-scale door knocking efforts, where you and your partner organizations can cover multiple neighborhoods.

- Flyer in public areas and put CTC postcards in people’s mailboxes.

- Table in public spaces and organizations that serve hard-to-reach populations. Sign people up on the spot if you can.

- Phone bank, email and text people on your organization’s contact list to remind them to get their CTC advance payments if they have not already done so.

Post social media graphics on Facebook, Instagram, and Twitter.

- Publish this image with the following caption:

| Facebook: ICYMI it’s not too late to sign up to receive the Child Tax Credit. Even if you don’t have income or taxes filed, parents and caregivers can help support their children with things they need most: food, home essentials, and school supplies. Visit GetCTC.org to learn more. |

|

The Child Tax Credit advance payments provide critical financial support for families and children that are most impacted by the pandemic, the majority of whom have low incomes and are people of color. The CTC also provides a historic opportunity to reduce child poverty in the United States by more than 40 percent. We have 6 weeks (until November 15) to help ensure that as many eligible people as possible get their money. Let’s get to work!

Let us know what you will do or reach out if you need help developing your campaign.

CTC Resources

- 2021 Child Tax Credit Outreach Resources: This outreach hub features a CTC outreach toolkit, IRS Child Tax Credit Update Portal Guide, CTC FAQs, navigator trainings to help people sign-up for advance payments, multilingual CTC outreach resources, tips on conducting local outreach, research on CTC-eligible households, and more.

- GetCTC.org Navigator Resources: This hub features resources from Code for America to help connect your community to the CTC.

- GetCTC.org: This resource helps people determine eligibility for the CTC and how to get it. It is also available in Spanish.

- 211: Call for live assistance with general CTC questions or look up local resources online.

- GetYourRefund.org: Connect virtually with an IRS-certified volunteer to file taxes for free.

- Low-Income Taxpayer Clinics: Provides free legal help on tax issues with the IRS.

- Taxpayer Assistance Centers: Provides support with limited tax issues. Appointments required.

- IRS CTC Hotline: Call (800) 908-4184 to connect with an IRS operator and get answers to general questions about the CTC and advance payments.