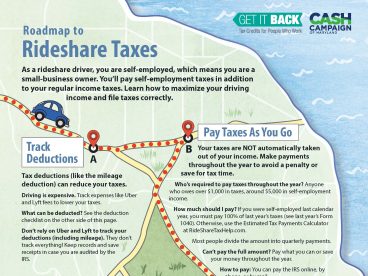

People who work for an employer have a portion of their taxes taken out of each paycheck. Self-employed workers don’t, so you’ll need to pay your own taxes. Most self-employed workers pay quarterly estimated taxes. You can use this simple tool to calculate your estimated taxes.

If you expect to owe more than $1,000 in taxes (that’s earning roughly $5,000 in self-employment income), then you are required to pay estimated taxes. If you don’t make estimated tax payments, you may be charged fees by the IRS.

Estimated payments are due four times a year on the following dates:

| Income from: | Quarterly Estimated Taxes Due: |

| January 1 to March 31 | April 15 |

| April 1 to May 31 | June 15 |

| June 1 to August 31 | September 15 |

| September 1 to December 31 | January 15 of the following year |

You are required to pay 100 percent of the total of your prior year’s taxes or 90 percent of your estimated current year’s taxes. If you make over $75,000 as a single filer ($150,000 if married filing jointly) in self-employment income, you must pay 110 percent of last year’s taxes.

If you didn’t owe taxes last year, you aren’t required to make estimated tax payments. However, it is a good idea to pay estimated taxes so you don’t have a large bill at tax time that you are unprepared to pay.

If this is your first time earning self-employment income, you can estimate your yearly income based on your weekly earnings. Use this simple tool to calculate your estimated payment.

How to Pay

There are several easy ways to make your payments.

1. Electronic

If you’re comfortable online, one option is to use the Electronic Federal Tax Payment System (EFTPS). You’ll have to enroll on their website. Just make sure to do this before a payment is due, as you won’t be able to make any payments the day you register.

Another electronic option is Direct Pay on the IRS website. Direct Pay does not require registration and, like EFTPS, makes payments directly from your bank account. There are no fees associated with direct bank transfers.

To make payments by debit or credit card, choose one of the IRS approved payment processors and note the varying processing fees.

If you e-file your taxes, you can make and schedule payments from your bank account at tax time with Electronic Funds Withdrawal.

2. Phone

You can choose one of the IRS-recognized service providers to make payments by phone with a credit or debit card. Ask about the processing fees before sharing your card information so you aren’t surprised.

Alternatively, once enrolled with EFTPS, you can make payments by phone.

3. Mail

If you prefer making a physical payment, you can mail a check or money order for your estimated payments. Once you’ve calculated the amount you must pay, fill out the payment voucher on Form 1040ES. This is the least secure payment method. Carefully consider other options available to you before mailing a payment.

Preparing for payments

Remembering to pay your estimated payments can be tricky. Set your own calendar reminders, phone alarms, or whatever it takes to remember these important deadlines.

It can also be hard to put money aside for quarterly estimated payments. One option is to establish automatic monthly or biweekly bank transfers to a designated account so that you don’t have access to any money you set aside for your taxes. You can also treat these payments like a bill and send a portion to the IRS each month when you pay other bills.

If it’s tax time and you can’t afford to pay your taxes, file your taxes anyway, as not filing can lead to penalty fees.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities and the CASH Campaign of Maryland are not liable for how you use this information. Please seek a tax professional for personal tax advice.