By Christine Tran, 2021 Get It Back Campaign Intern

Last updated June 9, 2022

If you receive unemployment compensation, your benefits are taxable. You will need to report Form 1099-G, Certain Government Payments, on your federal tax return. Most states mail this form to you, but some do not. (Some states may send more than one Form 1099-G. Use all to prepare your tax return.) Scroll down for how to find your Form 1099-G. To learn how to file your tax return if you receive unemployment compensation, read Do I Have to Pay Taxes on my Unemployment Benefits.

As part of economic relief efforts from the COVID-19 pandemic, you don’t have to pay tax on the first $10,200 of unemployment benefits you received in 2020 if your income is under $150,000.

Please note that this information may change. This information is accurate as of 03/16/22.

Click on any of the following links to jump to a section:

- What is Form 1099-G?

- How do I get form 1099-G?

- I received a 1099-G, but didn’t file for unemployment benefits in 2020. What happened?

- Need help with Unemployment Compensation Taxes?

What is Form 1099-G?

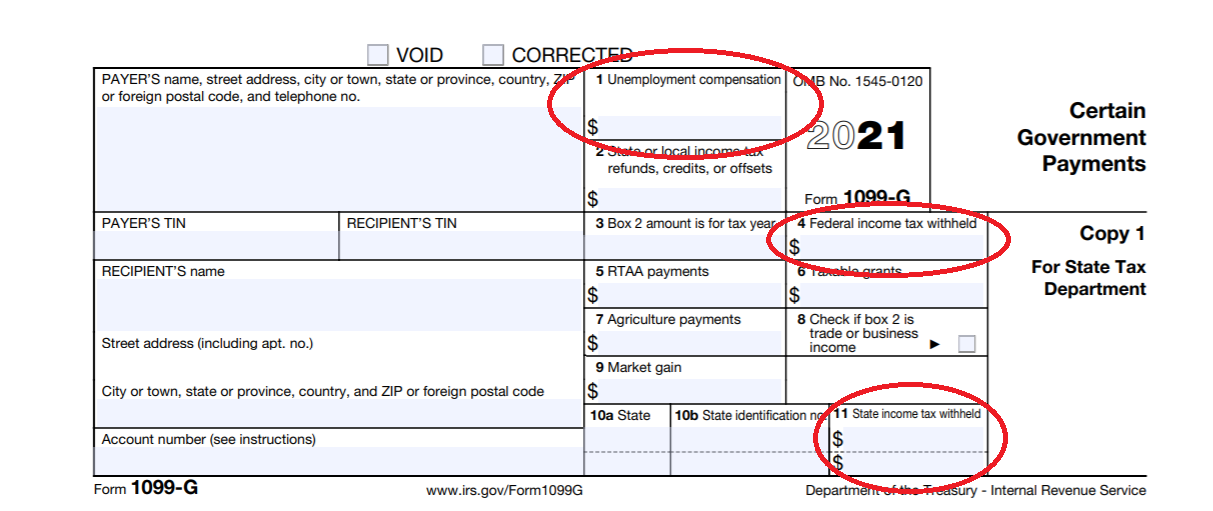

Form 1099-G reports the total amount of taxable unemployment compensation (Box 1) paid to you. This includes:

- Unemployment Insurance (UI) benefits including Federal Extensions (FED-ED), Pandemic Additional Compensation (PAC), Pandemic Emergency Unemployment Compensation (PEUC), and Lost Wages Assistance (LWA)

- Pandemic Unemployment Assistance (PUA) benefits

- Disability Insurance (DI) benefits received as a substitute for UI benefits

- Disaster Unemployment Assistance (DUA) benefits

- Paid Family Leave (PFL) benefits

Form 1099-G also reports any amount of federal (Box 4) and state (Box 11) income tax withheld.

How do I get Form 1099-G?

Your state unemployment office will usually mail you this form by January 31 of each year if you received unemployment compensation the prior year.

These are the states that will automatically mail your Form 1099-G:

• Alabama

• Alaska

• Arizona

• Arkansas

• California

• Colorado

• Delaware

• Georgia

• Hawaii

• Idaho

• Iowa

• Kansas

• Kentucky

• Maine

• Massachusetts

• Minnesota

• Montana

• Nebraska

• Nevada

• New Hampshire

• New Mexico

• North Dakota

• Ohio

• Oklahoma

• Oregon

• Pennsylvania

• Rhode Island

• South Carolina

• South Dakota

• Tennessee

• Texas

• Vermont

• Virginia

• Washington

• Washington, D.C.

• West Virginia

• Wyoming

These are the states that will either mail or electronically deliver your Form 1099-G, depending on what you opted into:

Florida

• You can access your Form 1099-G through your Reemployment Assistance account inbox.

• The fastest way to receive your 1099-G Form is by selecting “electronic” as your preferred method for correspondence. Go to “My 1099-G” in the main menu to view Form 1099-G from the last five years.

Illinois

• Access your Form 1099-G online by logging into your account at ides.illinois.gov.

• If you haven’t already, you will need to create an ILogin.

Indiana

• Access your Form 1099-G online by logging into your account at in.gov. Go to your Correspondence page in your Uplink account.

Maryland

• To reduce your wait time and receive your 1099G via email, sign up electronically by creating a BEACON account or using the MD Unemployment for Claimants mobile app.

Michigan

• If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

• To view or download your Form 1099-G,

o sign into your MiWAM account and

o click on “I Want To”, then

o “1099-G” then choose the tax year.

• To change your preference, log into MiWAM.

o Under Account Alerts, click “Request a delivery preference for Form 1099-G” and then select the tax year.

Mississippi

• To access your Form 1099-G online, log into your account and follow the instructions sent by email on where you can view and print your Form 1099-G.

North Carolina

• Log onto your online account at des.nc.gov. Form 1099-G for years 2018 onward are available.

• To request a printed copy of your 1099-G form from 2018, 2019, 2020, or 2021, send a fax or email to 919-733-1370 or des.ui.claims.1099@nccommerce.com. You can also mail:

Division of Employment Security

Attn: Intrastate Claims Unit

P.O. Box 25903

Raleigh, NC 27611-5903

• The written request must include your complete name, complete address, phone number, last four digits of SSN or Claimant ID, and date of birth. Once received, requests are processed within 48 hours. There is no cost for years 2018, 2019, 2020 and 2021 (current).

• Requests for 1099-Gs for years before 2018 may be submitted to the Legal Services Section using the Request for Release of Information Form. The fee for years prior to 2018 is $15.00.

Utah

• To access your 1099G, log in online at https://jobs.utah.gov/ui/home/Home/TenNintyNineTaxInformation and select “1099 Tax Information.”

These are the states that will not mail you Form 1099-G. The form will only be accessible online:

Connecticut

• Access your Form 1099-G on-line using the Connecticut Department of Revenue’s Taxpayer Service Center (TSC).

Georgia

• You can access your Form 1099-G on the Georgia Tax Center by selecting the “View your form 1099-G or 1099-INT” link under Individuals.

• Detailed instructions here: How to Request an Electronic 1099-G and 1099-G and 1099-INT Search (Instructional Guide)

Louisiana

• Access your Form 1099-G by logging into your HiRE account then clicking on “Unemployment Services” and then “Form 1099-G Information.”

Missouri

• Access your Form 1099-G online at https://mytax.mo.gov/rptp/portal/home/1099g-inquiry or by calling the Missouri Department of Revenue at 573-526-8299. You will need your social security number, zip code and filing status on your most recently filed tax return. Taxpayers living outside of the United States will need to enter 00000 in place of a zip code.

New Jersey

• Access your Form 1099-G by visiting New Jersey’s Department of Treasury website.

New York

• To access your Form 1099-G, log into your account at labor.ny.gov/signin. Click the “Unemployment Services” button on the My Online Services page. Click the “Get Your NYS 1099-G” button on the Unemployment Insurance Benefits Online page.

Wisconsin

• Access your Form 1099-G on the Wisconsin Unemployment Insurance Benefit Services.

• Log on, then select “Get your 1099-G” from My UI Home to access your 1099-G tax forms.

I received a 1099-G, but I didn’t file for unemployment benefits in 2020. What happened?

If you received Form 1099-G, but didn’t file for unemployment benefits, this may be a case of identity theft and fraud. Contact your state unemployment office immediately for additional information and how to report the potential fraud.

The state will send a corrected Form 1099-G to the IRS to state that you did you not receive benefits. Don’t report it on your federal tax return, or the IRS will assume that you have received unemployment benefits and you may have to pay taxes on it.

Need help with Unemployment Compensation Taxes?

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for America’s Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 18, 2022.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.