By Christine Tran, 2021 Get It Back Campaign Intern

Last updated June 9, 2022

Yes, you need to pay taxes on unemployment benefits.

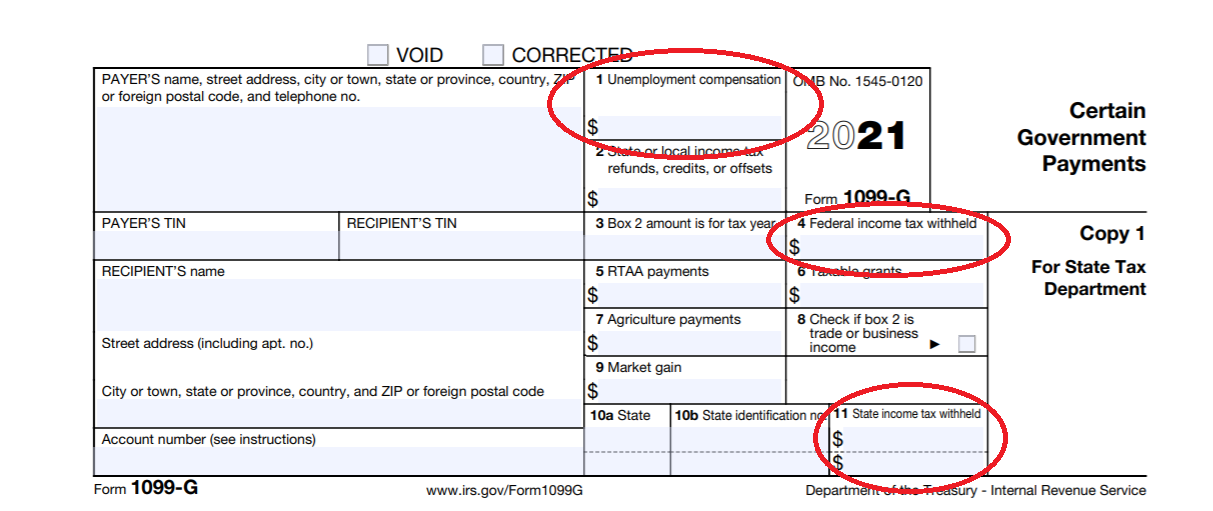

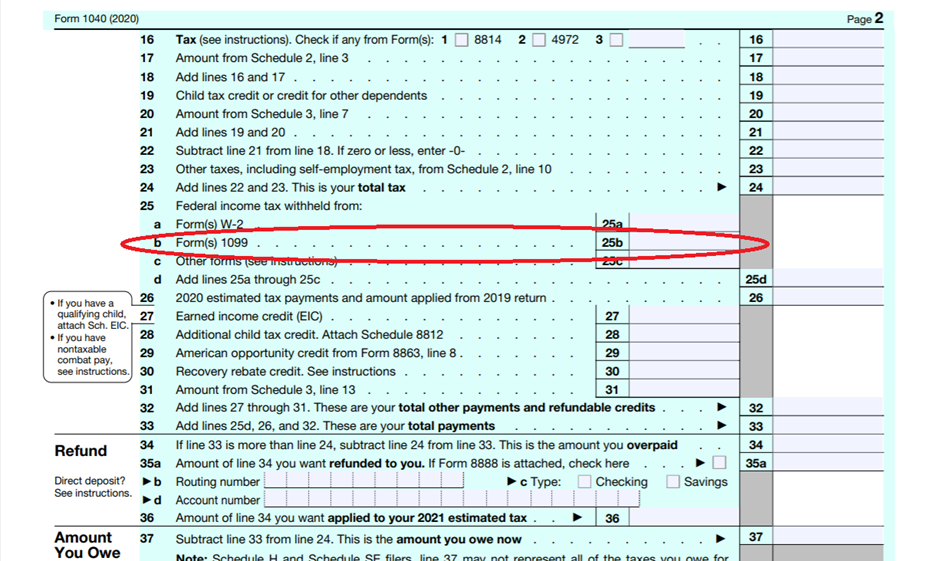

Like wages, unemployment benefits are counted as part of your income and must be reported on your federal tax return. Unemployment benefits may or may not be taxed on your state tax return depending on where you live. Regardless, you must pay federal taxes on your unemployment benefits.

If you received unemployment benefits, your tax refund may be smaller than in previous years. If you didn’t pay taxes on your unemployment checks as you received them, your tax refund may be used to pay for the taxes that you owe, resulting in a smaller refund.

For Tax Year 2020 (taxes filed in 2021, you don’t have to pay tax on the first $10,200 of the unemployment benefits you received in 2020 if your income is under $150,000. However, this does not apply for Tax Year 2021 (taxes filed in 2022).