Did you know that millions of eligible people could miss out on their Economic Impact Payments (EIPs) – commonly called “stimulus checks” – because they have to file an online form with the IRS to get it? While most people get their payments automatically after filing a tax return (or based on participation in certain federally administered programs), this group of “non-filers” must take action to get their money (worth $1,200 for adults and $500 for qualifying children).

Eligible individuals have until November 21 to file for their EIP using the non-filer form this year, so there’s a lot of work to do to get the word out.

Get started with EIP outreach efforts here: Stimulus Payments Outreach Resources

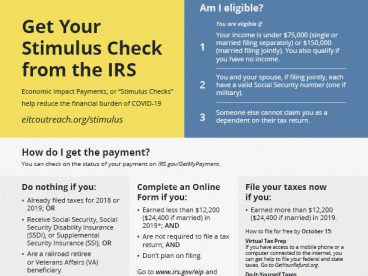

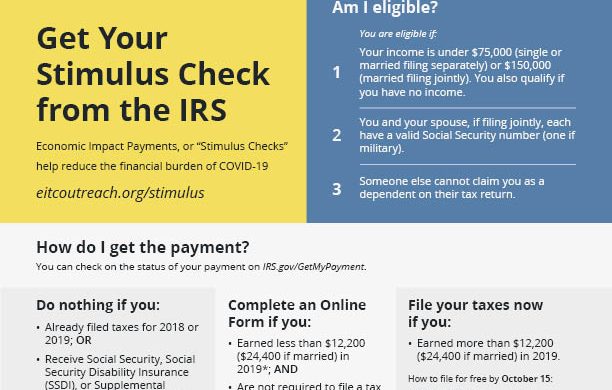

8 x 11 Informational Flyer

Share this 8.5 x 11 flyer to help inform people about the EIP.

You can download the flyer in the following languages:

Download this folder to customize the flyer with your organization’s information. Read through the included instructions before editing the Word document.