A United Way survey finds that Americans are leaving money behind at tax time, CFED partners with J.P. Morgan Chase Bank to address racial inequity, and Coloradoans can claim the state EITC again.

- Even with 80 percent of tax filers winding up with a tax refund each year, a recent United Way survey found that most low- and middle-income Americans are still leaving money on the table at tax time.

- The Oklahoma Senate passed a bill that would defund the state EITC and other benefits for two years.

- A newly founded partnership between J.P. Morgan Chase Bank and CFED aims to address financial and racial inequity by developing leaders in local organizations of color. In 2014, J.P. Morgan was sued for mortgage discrimination against borrowers of color; this partnership is part of its restitution plan.

- The National LGBT Taskforce has created Queer Our Taxes: Taxation with LGBTQ Representation, a guide to educate the LGBTQ community on how to properly file their taxes.

- Eligible tax filers can claim the Colorado state EITC for the first time since 1999. Colorado workers could qualify for more than $70 million in refunds.

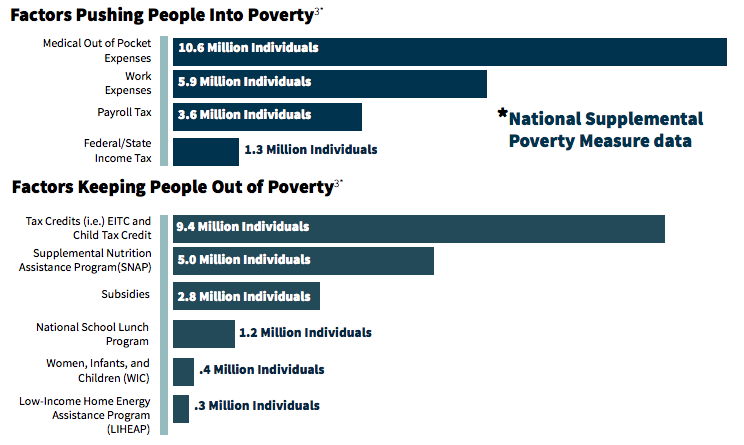

- A report from Missourians to End Poverty shows that the EITC, along with other tax credits and government programs, helped Missourians out of poverty.

Graph from the 2016 State of the State Poverty in Missouri report