By Janne Huang

Friday, January 29, 2016 marks the tenth annual EITC Awareness Day. On this day, the IRS encourages organizations across the country to bring attention to the EITC by hosting events and engaging the media.

This is also a time to highlight free tax preparation and other refundable tax credits like the Child Tax Credit, the American Opportunity Tax Credit, and the Premium Tax Credit.

Send us links to your media coverage and if you don’t have time to plan an event, not to worry! You can still get involved with these four simple ways to promote EITC awareness.

1. Promote the EITC and CTC’s value and impact

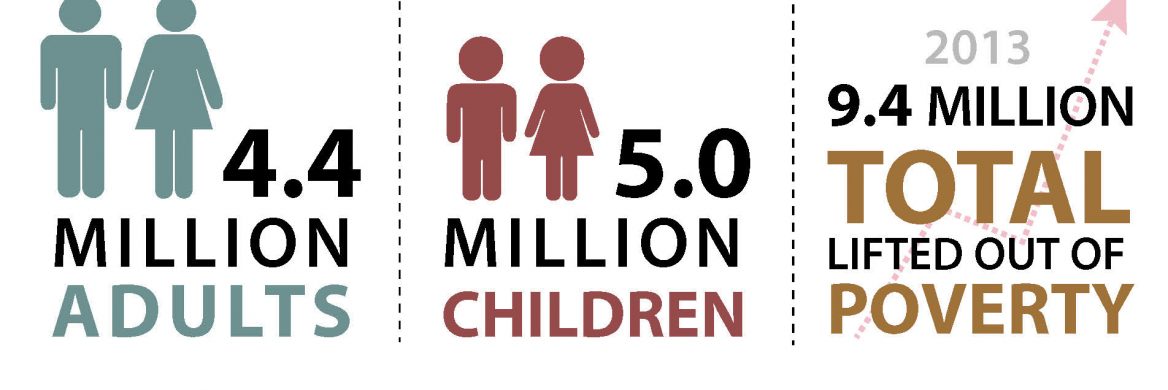

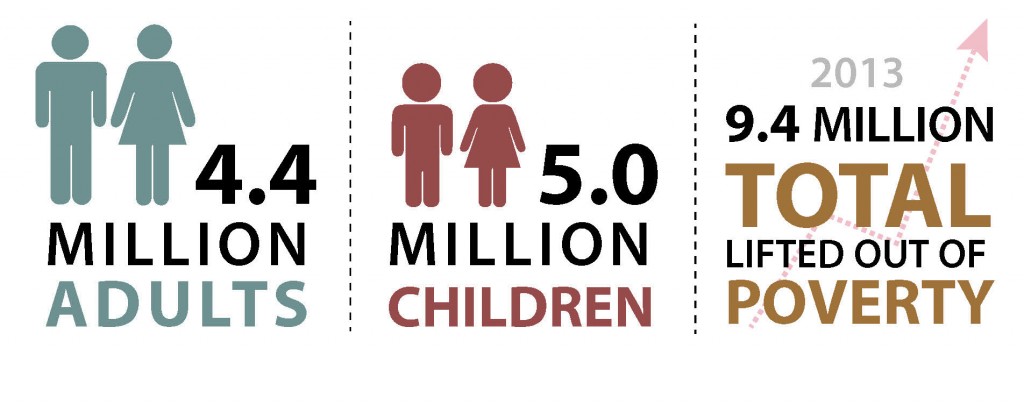

In 2013, the EITC and CTC raised more than 9 million people in working families above the poverty line, including 5 million children. Share tax credit infographics with your partners, public officials, and local media.

Find out how many families in your state claimed the EITC here.

2. Plugin to social media

Follow us on Facebook for great images and message you can share with your followers. On Twitter, use #EITCAwarenessDay and check out these sample tweets. Join the IRS Thunderclap to let others know about the EITC.

![]()

3. Profile an EITC earner

Share the story of a worker whose family has benefited from the EITC at an event, in a newsletter, through a video, or in an interview. Focus on one key fact in press releases and event invitations, such as the average family refund or the total EITC dollars brought into your community.

Learn about EITC participation in your state.

4. Provide EITC resources to clients and partners

Distribute outreach materials about the tax credits to families and partner organizations. Help workers learn eligibility requirements and where to find free tax help. Customize posters and flyers to add details about your local VITA site.

So, what are you doing for EITC Awareness Day? Let us know on our Facebook page.